History

Today Lifco is one of Sweden’s most impressive serial acquirers. But, this story starts in 1995 when Getinge acquired the dental company LIC Care AB, which later became Lifco. Carl Bennet (also the principal shareholder of Getinge) became the main shareholder of Lifco in conjunction with the IPO in 1998 after being spun off from Getinge. However, the listing was short-lived. A few years later, he assessed that the company needed restructuring and would develop best off the stock market. Hence, in 2000 Lifco became a wholly-owned subsidiary of Carl Bennet AB. Six years later, in 2006, Lifco gained its current form after acquiring Sorb Industri, a diversified industrial company owned by Carl Bennet AB. That became the start of a successful business expansion. Sales grew by 12.6% and EBITA by 16.8% year 2006-2014. Finally, in 2014, Lifco was listed again with Carl Bennet as the majority owner.

Lifco’s Business Concept

Lifco acquires and develops market-leading niche companies with robust financial performance and cash flow. After the acquisitions, the subsidiaries continue to operate in a decentralized structure, and Lifco reinvests the cash flow in new acquisitions.

The Lifco group is divided into three business areas: Dental, Demolition & Tools, and Systems Solutions. Through Dental, Lifco is the leading dental materials and equipment distributor in Northern and Central Europe. Demolition & Tools develops, produces, sells, and distributes remote-controlled demolition machines, tools, and accessories. Systems Solutions includes businesses that deliver systems solutions such as interiors for service vehicles, contract manufacturing, environmental technology, sawmill equipment, and construction materials. The geographical footprint predominantly covers Europe, although the sales split in the different businesses varies. In total, around ~30% of its sales are generated in the Nordic countries.

Lifco’s corporate philosophy is based on three pillars: a long-term perspective, focus on profitability, and decentralization. In a nutshell, Lifco’s approach to ownership is perpetual. This enables the subsidiaries to focus on long-term cash flow with continuous efforts to develop new products and increase their selling power. Regarding the second pillar, the focus on profitability is essential for Lifco. The group’s target is to grow EBITA faster than sales. Outsourcing basic manufacturing and non-core functions improve profitability, resulting in CapEx being ~2% of sales. Lastly, the group is decentralized. In principle, no decisions are made from the HQ. Lifco’s straightforward corporate structure has been crucial in persuading entrepreneurs to sell their life’s work to Lifco.

Sustainable Value Creation

Post-acquisition, the companies operate with a high level of autonomy. The aim is always to take decisions at the local management level. In practice, this minimizes central functions and resources, maintaining the culture of what Lifco calls “the antithesis of large corporate culture”.

In contrast to many acquisitions, Lifco does not strive to realize synergies and has never relocated operations. As the acquired companies are small and operate in niches, moving the competent workforce in acquired companies to a low-cost country is not reasonable. Another interesting point is that Lifco does not have complicated target settings for acquired companies. The CEO, Per Waldemarson, views hard targets as limitations and unsuitable for the model. Instead, the motivation for growth should come from within the subsidiary, not external sources.

Continuous pricing optimization for acquired companies is also stressed. The subsidiaries should not pursue volume production where price pressure is evident. Instead, companies should continue with premium products and aim to increase prices, revealing customers with the potential for sustainable profit growth. When a small subsidiary is part of the bigger Lifco group, it is easier to implement price increases. For example, individual family-owned niche businesses with customer concentration could be hesitant to increase prices as much as they should. Being a part of the Lifco group removes the uncertainty for the company, and Lifco can help to implement price optimization.

Financials

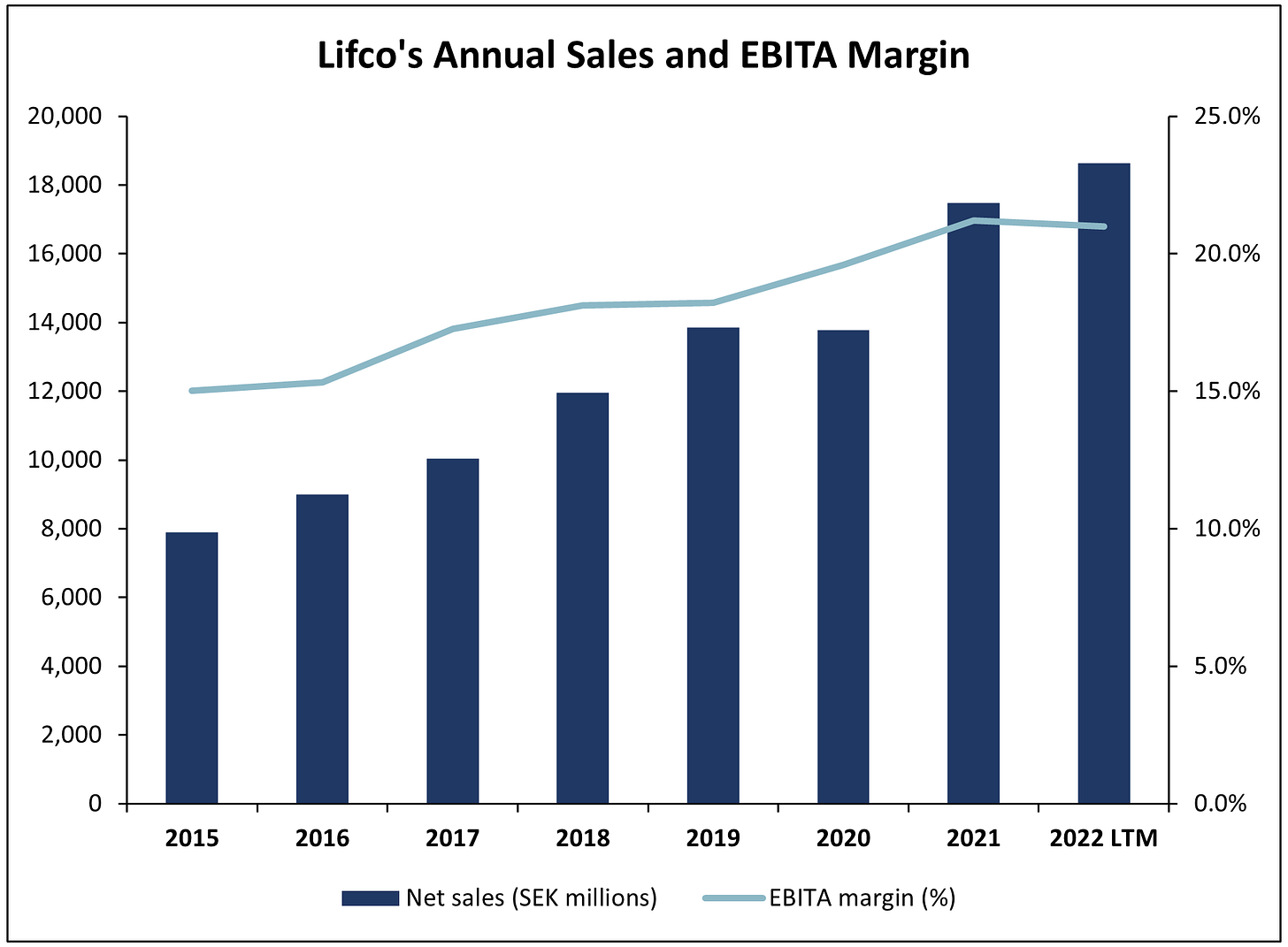

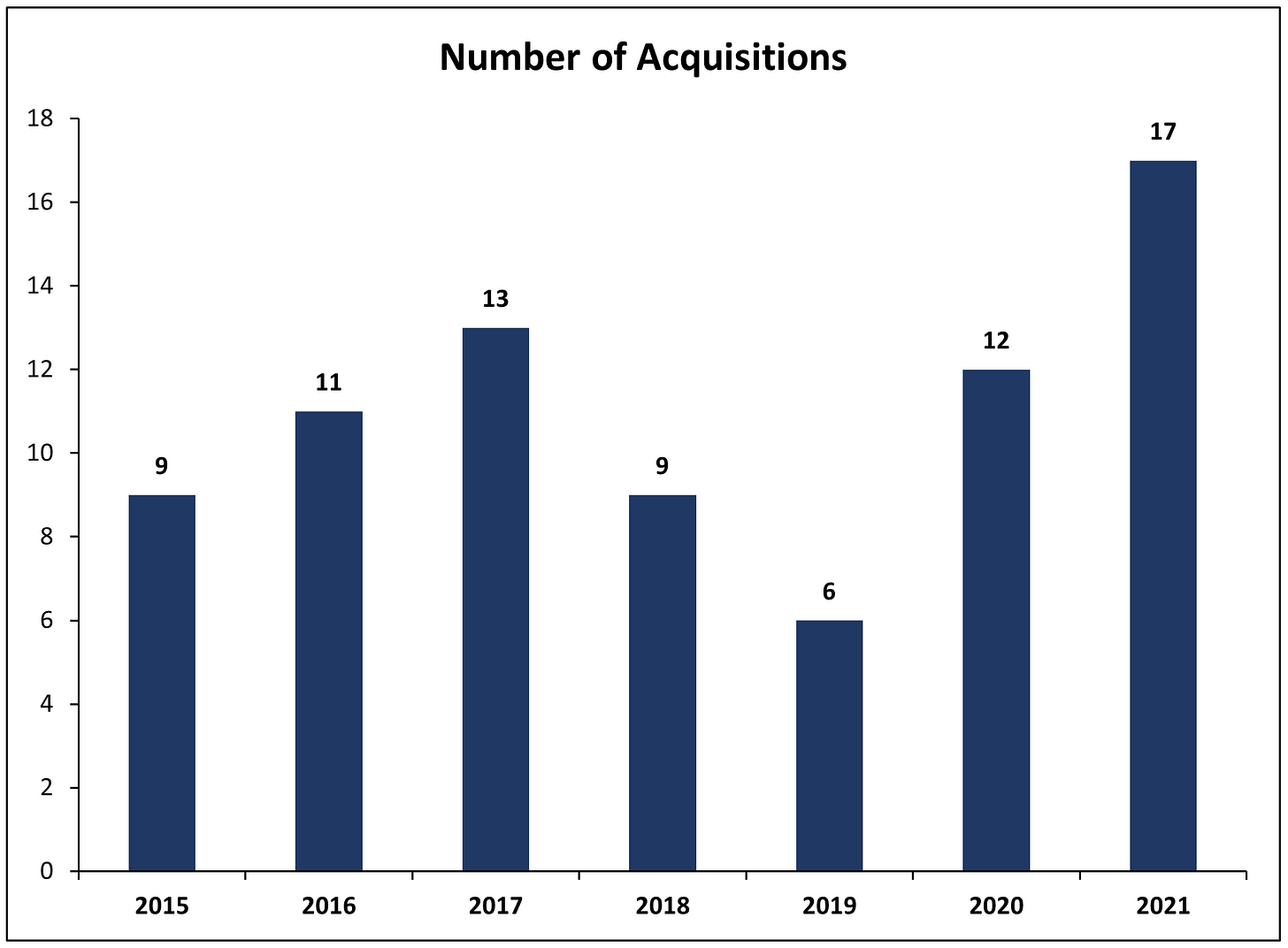

From 2015 to 2021, Lifco completed +70 acquisitions, and today Lifco consists of around 200 subsidiaries in 31 countries. As noted in the annual report, the acquired businesses have consistently generated strong financial results, and Lifco has reported a return on capital employed of about 20% over ten years. From 2015 to 2021, sales have grown at a CAGR of 14%, which is not only attributable to acquisitions but also an average organic growth rate of 4,3%. The fascinating observation is that EBITA has grown at a CAGR of 21% over the same period, with an average organic growth rate of 7,9%. As profits are growing faster than sales, Lifco has a good cash flow generating business where cash flow from operating activities has grown at a CAGR of 21% (2015-2021). The strong cash flow has allowed Lifco to reinvest in M&A at high rates of returns.

The gearing of Lifco is an essential metric in examining future firepower. This is one of the limiting factors when the company looks to continue to expand through its acquisition-driven business model. The financial target is to maintain interest-bearing net debt at 2-3x EBITDA. However, due to the substantial cash-generating businesses Lifco acquires, interest-bearing net debt/EBITDA has never exceeded 2.0x (2014-2021). As of Q1 2022, interest-bearing net debt stood at 1.1x EBITDA, which means that Lifco possesses the financial scope to make additional acquisitions.

As shown below, the trend of the EBITA margin is remarkable. Lifco has expanded the EBITA margin from 15% in 2016 to over 20% in 2022. The crown jewel is the Demolition & Tools segment which has had a consistent EBITA margin of over 20%. The segment boasts a 26% LTM EBITA margin in Q1 2022. The increasing margins are driven by Lifco’s continuous focus on improving the profit margin organically and acquiring companies with higher profitability. Of course, this trend will be difficult to repeat, even though the margins within Demolition & Tools show that one should be careful to claim where the ceiling is. As some of Lifco’s companies have longer order books, the margin is slightly negatively affected by increasing raw material pricing. However, with a portfolio of subsidiaries with robust niches and pricing power, I feel comfortable that Lifco can deal with inflation. Therefore, EBITA margins are sustainable.

Lifco has not been immune to the supply chain situation in the world. Due to these challenges, many Lifco companies have increased inventories to build up a safety stock. In Q1 2022, inventories increased ~19% vs. Q4 2021. Despite the increasing inventory, it is not too concerning relative to the organic growth rate of 14% in Q1 2022. Overall, solid organic growth is not driven by customers saving stock. Waldemarson noted that you could see those effects in more component manufacturing types of business. But it is not a dramatic effect as many companies manufacture expensive CapEx-driven machines for an end user. When the company reports its H1 2022 report, the impact of those supply chain issues should be monitored. Hopefully, the safety stock has made sure that Lifco can deliver going forward.

Since the IPO, Lifco’s average annual dividend growth has been 16.3%. The payout policy states a payout ratio of 30–50 percent of earnings after tax. From 2014 to 2021, Lifco’s average payout ratio has been ~30%. While the dividend can discipline management, it is less efficient for shareholders to compound the capital than if Lifco were able to reinvest it all and reach comparable rates of return. Unfortunately, Lifco can not reinvest all cash it generates and earn an attractive rate of return.

M&A Scaling

For serial acquirers such as Lifco, it is essential to ensure that the company thinks seriously about scaling deal volume. During the 2021 Q4 earnings call, CEO Per Waldemarson stressed that Lifco has a better organizational structure to scale the M&A today than 2-3 years ago. As shown below, around ten people in Lifco work as Group Managers. These individuals are Chairman of acquired companies and give leads to the Group Management, responsible for the transactions and valuation of acquired companies. Suppose Lifco wants to scale the M&A without losing returns on incremental capital. In that case, the company only needs to increase the Group Managers by 3-5 persons and continue to acquire companies with 100-200 SEKm sales (Per Waldemarson: “I have full confidence that the Group Managers can be Chairman in the acquired companies in a Lifco way because they have worked through the system”). Smaller transactions are favorable as larger acquisitions would be the fastest path to mediocre returns on incremental capital. Additionally, if the number of acquisitions increases, I believe that the Group Management with Per Waldemarson still can handle the due diligence and valuation process. Therefore, I see no reason why Lifco would not be able to ramp up acquisitions in the future.

As more PE firms have gained the interest of niche companies, the competition for acquiring these companies has increased. Therefore, M&A multiples on acquisitions can grow in the future, but slowly. However, the quality and valuation of the acquired companies have not worsened. For that reason, Lifco can continue to earn a return on new invested capital well above their cost of capital in the future. Typically, Lifco pays between 6-8x operating profit for the acquisitions. Although the competition has increased, there is still room to run. In an interview with Dagens Industri, Per Waldemarson states that the management team looks at more cases than ever before but with cautious eyes.

Management

Shown above is a simplified structure of Lifco. Unsurprisingly, the Chairman of the Board, Carl Bennet, has been in the position since 1998. Per Waldemarson was appointed CEO and President in 2019. He started at Lifco in 2006 and has worked as CEO of Brokk (a company in Lifco) and Head of business area Dental. Waldemarson took over after former CEO Fredrik Karlsson was fired after a schism over bonus compensation.

Despite sales of approximately SEK 18 billion and 6,200 employees in the subsidiaries, the parent company Lifco comprises only around ten people. As Lifco is highly decentralized, the small group at the HQ sends the proper signal to the rest of the group. The Group Management consists of people who have been with Lifco for 6-14 years. Most of them have previously worked in Lifco’s subsidiaries. Around ten people in Lifco are working as Group Managers. This group of people have been with Lifco for +10 years and has responsibilities such as being Chairman of acquired companies. In conclusion, all leading figures in Lifco are well acquainted with Lifco’s culture and processes, which have given them relevant experiences in this business. In my view, you can not ask for a better team.

Looking at the insider’s ownership below, we can conclude that there is enough skin in the game. The company’s largest shareholder, Carl Bennet, holds 69% of the total number of votes in the company. Moreover, CEO Per Waldemarson also has a significant stake and increased his holding by 2 SEKm after Lifco’s 2022 Q1 report.

Per Waldemarson and three others in the Group Management team receive variable cash bonuses. For the CEO, variable compensation is tied to several factors such as earnings, volume growth, working capital, and cash flow. Lifco does not issue stock as compensation for the Board or when acquiring. Furthermore, in 2021, Carl Bennet AB (100% owned by Carl Bennet) offered all Directors to acquire synthetic call options, except for Carl Bennet and all senior executives in Lifco. The transaction proves Carl Bennet’s efforts to keep the incentive alignment within Lifco.

All told, Lifco has a great board and management team, which are properly aligned with public shareholders.

Valuation

In terms of valuation, Lifco is trading at a ‘22e-’24e EV/EBITA of ~20x, based on the current share price and consensus estimates from FactSet. This is approximately 5% above the peer group median, consisting of relevant roll-up peers. Given Lifco’s strong capital allocation track record and sustainable margin profile, I argue that the premium is justified. However, as noted, the multiples are high, and Lifco does not come at a bargain. Even though the valuation has fallen in recent months, with EV/EBITA ~20x 2022, the share is still trading in the upper part of the valuation interval before COVID. Therefore, it might still be too early to become a buyer.

Lifco’s management has proven superior capital allocators in the long run. With a relatively young CEO, Lifco will continue to scale small M&A at high RONIC. Furthermore, in contrast to many observers of Lifco, I argue that the margins are sustainable in the long run. The management team exhibits a pattern of behaviors and philosophies that makes them great capital allocators, whether in Dental, Demolition & Tools, or Systems Solutions.

For these reasons, I think you can still pay a full multiple and do well over the long term.

A good write-up introducing of one the highest-rated Swedish serial acquirer stock market darlings of recent years.

(Being value-biased I would agree with the more conservative valuation conclusion.)

Look forward to more Nordic write-ups from Markus Olsson's new Substack!

have you looked at Instalco? A writeup would be great. The valuation looks compelling at this juncture.