In 2017, the activist hedge fund Marcato Capital Management took a significant position in Deckers Outdoor Corporation. The hedge fund intended to discuss strategy and options for the company, which comprises brands such as Ugg, HOKA, Teva, and Sanuk. Certain criticism from Marcato was fair. The company had opened too many stores, acquired too many brands, and misallocated inventory. Simply said, the management had gotten lazy. But Marcato also called for an overhaul of the board of directors and a potential plan to sell Sanuk, Teva, and, more importantly, HOKA. However, the new CEO David Powers and the management team concluded that the best path forward was to beat back. The company showed that well before Marcato’s filings, Deckers had taken proactive steps to transform its business of designing and selling its own shoes and apparel.

In 2016, Powers and the management set targets to deliver value to shareholders. The turnaround strategy was pretty typical: consolidate operations, optimize its previous retail store expansion, develop a solid digital presence, and prioritize product and innovation. These initiatives defeated the activist investor. With the plan, management had a long-term target to reach $2 billion in revenues, increase the operating margin to +13% and improve the return on invested capital above 20% by FY 2020. All of which they delivered ahead of time in FY 2019. Since the accomplishment in FY19, the company has continued to improve: the operating margin increased by ~200 basis points and maintaining a healthy revenue growth with a return on invested capital well above 20%.

Quietly, Deckers Brands has built a multibillion-dollar ugly shoe empire. Its main brand is Ugg, most known for its sheepskin boots. While Ugg has its core hits, the company realized it needed to emphasize product design and let designers go wild in search of the next big breakout. One attempt at innovation was two pairs of crossbred Ugg boots and Teva sandals named “The Ugliest Shoes of All Time” by Cosmopolitan. But according to Powers, that was on purpose: “It was uglier than I thought, but I was like, look, we just need to get noticed.” Since then, Ugg has benefited from strategic experimentation. Launching the Ultra Mini that is viewed more as a sneaker alternative and more dial-backed designs such as Tazz, which sold out at upscale retailers such as Saks and even spotted on celebrities like Gigi Hadid.

The company acquired HOKA ONE ONE (pronounced “Ho-Kah Own-ay Own-ay”) in 2013. This is the company’s most lucrative bet on weird. Despite operating in a fiercely competitive athletic market dominated by Nike and Adidas, the brand has had an incredible rise with its cushiony, light, and premium shoes. Founded in France by a top-tier trail runner and a French maximalist sneaker designer (who now runs Deckers’ experimental lab), all the shoes have one distinctive feature. The oversize mid-sole.

The success of HOKA has been incredible. Sales for the brand are up ~3000% since FY14, going from ~$30 million to ~$900 million in FY22. Additionally, according to a company spokesperson, HOKA currently holds a 24% market share in the specialty running space as of May 2022. HOKA’s incredible run—supported by its innovation at heart—speaks to the brand strength, which has achieved the near-impossible status of both a cult brand among hardcore runners and swooned over by the anti-athletic, fashion-forward crowd. The brand is Deckers’ fastest-growing business, with revenues rising 56% in FY22 and accounting for ~30% of the company’s revenues.

Direct-to-Consumer (DTC)

A crucial part of Deckers’ future success will be the company’s ability to grow the DTC business through consumer acquisition and retention.

While the wholesale business, with key partners such as DICK’S Sporting Goods, has accounted for a significant percentage of Deckers’ revenues, its digital initiatives have helped the growth rate—with the DTC revenues growing at a CAGR of 11% from FY16 – 22 (vs. wholesale 8% CAGR). Most of the incremental growth for the DTC channel has come from HOKA, where DTC revenues have climbed >10x from FY18 – FY22 (DTC representing 14% of HOKA’s revenues in FY18, increasing to 29% in FY22).

Establishing a direct relationship with customers is most important to drive profitable growth. As noted in the Q4 FY22 call by CEO David Powers, the 6 million members of the Ugg loyalty program generates substantial revenues: “As the size and scale of the Ugg rewards program continues to grow, I want to highlight a few key metrics that emphasize the value of these loyal consumers. Such as that members count for approximately 40% or more of revenue in all regions where the program has existed for more than one year, and that members spend approximately 40% to 50% more than non-loyalty consumers.” Growing the DTC channel will enable the company to leverage the data and analytics for better inventory and higher full-price sell-through / average selling prices in an environment where first-party data is critical for success.

Even though HOKA has had tremendous success in the DTC channel, management sees good opportunities to drive the DTC penetration: with the long-term expectation that 50% of HOKA’s revenues to be driven by the DTC channel. With this mix shift, HOKA can showcase the breadth and newness of the brand’s innovative product assortment, including apparel, and provide a convenient consumer experience to drive repeat purchases. Reasonably, the mix shift will have meaningful implications for the global perception of the brand and its profitability.

Regions

The U.S., which accounted for 69% of Deckers’ FY22 revenues, has remained a critical region for Deckers over the past decade. Due to a maintained dominant position, Deckers has produced significant growth in the region with the domestic expansion of HOKA. Additionally, brand consideration for Ugg remains high in the U.S., especially among the younger generation (Q3 FY2022: “Ugg has delivered strong YTD growth in the U.S. where brand consideration remains at an all-time high among 18- to 34-year-old according to YouGov.”)

But, Deckers’ domestic growth may be in store for some short-term pressure. While growth in the recent quarters has been exceptional, management noticed that several strategic wholesale partners took in excess Ugg inventory in Q4 FY22. Therefore, management guided Ugg to grow low single digits for FY23. The question is if U.S. retail has seen a temporary pull-forward, considering that the domestic growth rate is significantly higher than in previous years. The significant domestic growth rate highlights the COVID tailwind, which might be brief. This is undoubtedly a short-term headwind and not the most critical point over the long run.

Deckers Brands also has an international presence, where international revenues accounted for 31% of the company's FY22 revenues. However, in contrast to the stable domestic growth rate, international revenue growth has been slower (domestic revenue CAGR 10% vs. international revenue CAGR 6% from FY16 – 22). It’s worth noting that the company, unfortunately, does not separate the international revenues into specific regions.

But in the last two years, international revenues have picked up, increasing 7% in FY21 and 25% in FY22. Approximately three years ago, Ugg started implementing an international reset strategy that previously reignited the brand in the United States. By highlighting new categories, reducing the supply of core products, and tailoring marketing campaigns to local consumers, Ugg has begun expanding its audience to younger consumers in Europe and China. CEO Powers noted the reasons for the strong international growth: “Similar to the U.S., we believe younger consumers are leading the Ugg brand increased popularity among international markets. The brand has worked hard to create localized content that resonates with the sub-35 age consumers in their respective markets. In Germany, France, and the U.K., this age group is driving over 40 percent of traffic conversion from paid social. In China, this age group is driving DTC growth in key franchises, including global styles such as left and the Classic Clear.” International growth has also accelerated due to HOKA’s continued global wholesale. The brand has seen increasing market share gains with strategic partners and identifying several growth opportunities overseas. And HOKA’s international brand heat is continuing in Q1 FY23, with international markets increasing 66% versus last year.

If we turn to the long-term, there is a high probability of building HOKA into a multi-billion-dollar player in the athletic performance space. The positive outlook on HOKA in Q4 should not be downplayed: “We’re still in a chase mode, and demand is still exceeding supply.” And the brand continues to fire on all cylinders with solid numbers in Q1 FY23. As I see it, HOKA has an excellent opportunity in all channels. Ultimately, wholesale remains the primary acquisition point for new customers, and HOKA will continue to grow globally with key partners. One of its new strategic relationships is Foot Locker, where HOKA will be displayed in a limited number of stores this summer, probably more focused on the domestic market. For HOKA, the partnerships show how the brand can expand and the opportunity to increase both international and domestic door counts over time. In June, the brand debuted its first global campaign, Fly Human Fly. Thus, the brand has been snowballing by word of mouth and is set for continued international growth as the brand awareness of HOKA is still relatively low.

While it’s still early for HOKA retail, the brand has launched new stores in China and pop-ups in New York, LA, and Chicago. According to CEO Powers, domestic pop-ups are all exceeding expectations, and the first permanent HOKA location will be in NYC by the end of FY23. While HOKA has had a slow start in China, the stores are now driving higher conversion rates in Q1 FY23. That said, HOKA face fierce competition in China from domestic brands such as ANTA and Li-Ning (e.g., ANTA’s revenues increased ~7x from 2013 to 2021).

Deckers’ brand management of Ugg has undoubtedly been a success, but their strategy also has material risks. Ugg is better positioned for international growth as the reset strategy that reignited the brand in the U.S. is working. That said, ugly fashion trends—such as Toms to Dr. Martens—inevitably cycle out. As a result, the management must navigate fast fashion trends and constantly work on engineering staying power. The concern is that the innovative products can fail, both domestically and internationally, over a long time.

Financials / Valuation

As shown below, Deckers has consistently generated gross margins of 45-50%. From FY15 – 22, due to a continued improvement in the cost structure (SG&A declined from 38% of sales to 31% of sales), Deckers’ operating margin expanded by ~900 basis points to ~18%. For FY23, the company expects the margins to remain stable relative to FY22.

In the short term, Deckers anticipates that price increases implemented for HOKA and Ugg will offset increased freight and materials costs. The increased costs for freight are noted in the Q1 FY23, with the gross margin declining 360 basis points versus last year. 260 basis points of the decline are explained by increased freight costs. The more flexible operating model that Deckers has developed will help them offset some short-term headwinds. In summary, the operating model shined through in FY22, where significant supply chain disruption also was experienced.

The company’s financial position remains strong, with no outstanding borrowings and ~$700 million in net cash. Regarding the balance sheet, inventory levels have significantly increased. However, it’s important to note that last year’s inventory levels were below normal operating levels due to supply chain disruption. Heightened inventory levels are expected to continue due to significant demand.

Even in the face of hard times, the company generates a sufficient amount of annual free cash flow. While further acquisitions remain unlikely, Deckers have the significant financial flexibility to pursue growth investments and other avenues, such as share repurchases, that can add to long-term per share intrinsic value.

Given the FY23 guidance of an EPS in the range of $17.50 to 18.35 but including share repurchases and a slightly better revenue growth, the stock trades at ~16 forward earnings (at the November high, the stock was trading at ~26x NTM earnings).

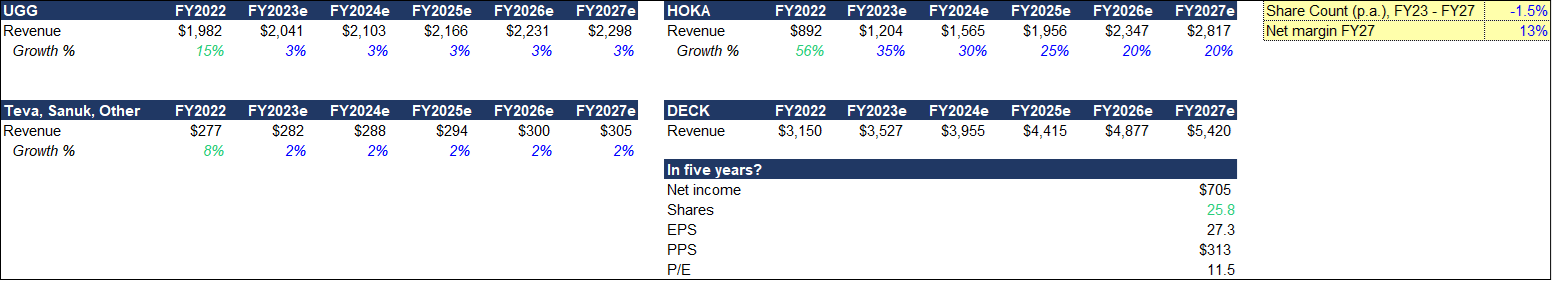

For a rough long-term back-of-the-envelope calculation, I assume that the annualized revenue growth rate will drop off for the major brands: low-single digit growth for Ugg and high double-digit growth for HOKA. Pinpointing the long-term net margin can be tricky–partly because of the unsure macroeconomic environment, which is likely to continue with high inflation. Nevertheless, I assume a net margin of 13%, which is in line with pre-COVID margins. Accounting for buybacks, the assumptions would imply FY27e EPS of $28 per share, a five-year CAGR of ~11% (Deckers Brands has repurchased $374 million of stock on an LTM basis, and as of Q1 FY23, the company has stock repurchase authorization of ~$1.5 billion).

Note that my revenue growth assumptions are one rough path for the company, and other, more negative, scenarios are possible. Also, the margin may be conservative. According to FactSet consensus estimates, the net margin is expected to expand in the coming years (likely driven by premium pricing by HOKA).

Conclusion

When interested in a company because of a particular product–such as HOKA ONE ONE–it’s important to let the numbers drive the analysis. For me, a couple of things stand when it comes to Deckers.

First, HOKA is an increasingly important brand for the company, accounting for ~30% of Deckers’ FY22 revenues. In addition, considering HOKA’s relatively low brand recognition, the brand can continue high double-digit annualized revenue growth over the long run. Along with strong growth, customers are willing to pay a premium for HOKA’s products due to its quality and brand. So, if HOKA is a future multi-billion dollar brand, it will have significant beneficial implications for the shareholders of Deckers Brands.

While HOKA has promising profitable growth prospects, the Ugg brand will have to continue to perform as it represents ~60% of total revenues. The company approach to brand management and the reset strategy has worked astoundingly well. I believe that the Ugg brand has better than average longevity and that the brand heat can remain with good brand management. Double-digit growth will not be the norm, but I see the brand's excellent potential to continue on a steady path in the long term.

One detraction of the company is that Sanuk and Teva can be distractions as they are quite irrelevant and small. Teva has had a resurgence in the last 24 months and growing steadily, but Sanuk seems to be dead and in a downtrend.

In summary, I anticipate that Deckers Brands have a positive long-term future ahead. At ~16x forward earnings and a path to increasing earnings with two strong brands, the market might be underpricing the company relative to its money-making potential. As I see it, short-term headwinds could potentially make this company even a more attractive buy.

For these reasons, I have started an initial position in Deckers Outdoor Corporation DECK 0.00%↑.

oh i hope you didnt sell. I read this report last year and still didnt pull the trigger.

Really great analysis here. Appreciate it.